Shared equity mortgage bad credit

Great credit with limited savings. This includes knowing the types of mortgages that are available including the bad credit mortgage sector and the type of lenders that would be willing to take a risk on a borrower with bad credit.

Home Equity Sharing Here Are The Pros And Cons Money

You pay subsidised rent and usually a service charge on the share you dont own which will be less than the market value.

. How to apply for a shared ownership scheme. You may apply for a Smart Refinance loan up to. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs.

If it doesnt agree you might have to pay this account off before you can refinance. PayPal is one of the most widely used money transfer method in the world. Mortgage required 47500.

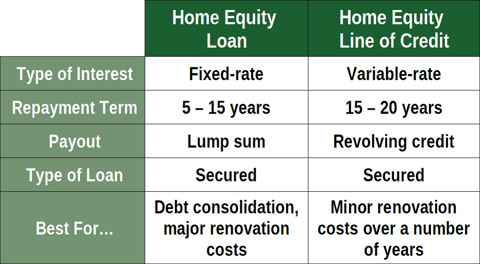

Bankrates home equity calculator helps you determine how much you might be able to borrow based on your credit score and your LTV or loan-to-value ratio which is the difference between what. If you have a home equity loan or line of credit also known as a HELOC you may have to ask that lenders permission to refinance your loan. Second mortgages come in two main forms home equity loans and home equity lines of credit.

Results are estimated based on a Smart Refinance loan amount of. She wants to cash out 50000 and reaches out to an equity sharing company to make it happen. We specialize in dealing with bad credit bank declines.

A Smart Refinance loan is a no-closing-cost mortgage refinance option that lets you take advantage of lower rates get cash out. Mortgage interest rates are lower than the interest. Lengthen your mortgage term.

A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1. This 100-million lending fund supports existing shared equity mortgage providers. A private-equity investment will generally be.

345 Homeowners association fee. For approx 720000 and buying the new house for 1mI will be putting in 500000 and. Thus if the propertys value decreases the borrower would still owe whatever principal is outstanding and if the borrower sells the property for a loss the.

While some banks and credit unions are localized in one state or region Connexus serves all 50 states through a co-op. Explore personal finance topics including credit cards investments identity. A credit rating is an evaluation of the credit risk of a prospective debtor predicting their ability to pay back the debt and an indicator of the debtor defaulting.

Our analysis of the entire mortgage market found just three lenders willing to offer shared ownership mortgages to people who have had credit problems in the past. Use TransUnions free mortgage calculator to quickly estimate what your new home will cost including taxes insurance PMI and the latest mortgage rates. For example imagine that your principal loan balance is 200000 and you want to cover 20000 worth of credit card debt with your equity.

If subsidised rent on the property is 100week but you own a 25 share youd pay 75week. The Shared Equity Mortgage Providers Fund is a 5-year program that launched on July 31 2019. Consider taxpayers ability to get an unsecured loan.

We also accept payment through. In this program the government offers a shared equity mortgage which reduces the amount of monthly mortgage payments but involves sharing a percentage of the increase in the equity value of the home when it is sold or at the end of. You have an existing home equity loan.

The loan is secured on the borrowers property through a process. Why Connexus Credit Union is the best home equity loan for a branch network. What is shared ownership.

At The Mortgage Hut we deal with over 90 lenders with over 12000 products so youll get the most suitable mortgage. If you have bad credit issues such as county court judgments CCJs or debt arrears you may struggle to find a lender willing to give you a shared ownership mortgage. Bad Credit Loans.

The Fund will also encourage additional housing supply and help attract new providers of shared equity mortgages. Private equity PE typically refers to investment funds generally organized as limited partnerships that buy and restructure companiesMore formally private equity is a type of equity and one of the asset classes consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange. Determine the priority of the Notice of Federal Tax Lien when considering whether to allow or disallow payments to other creditors.

Getting a home equity loan with bad credit requires a debt-to-income ratio in the lower 40s or less a credit score of 620 or higher and home value of 10-20 more than you owe. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. 58841 Estimated closing costs.

Shared ownership also known as part buy part rent is a type of mortgage that gives first-time buyers the chance to buy a share in a new build property. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. She still owes 300000 on her mortgage and has 200000 in home equity.

A shared appreciation mortgage differs from an equity-sharing agreement in that the principal of the loan is an unconditional obligation to the extent collateralized by the property. Learn how to figure out lenders mortgage insurance and how to minimise or avoid it. Share To Buy England not London.

We turn a no into a YES. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. A cash-out refinance means youd take a loan with a 220000 balance and your lender would give you 20000 in cash.

Consider unencumbered assets equity in encumbered assets interests in estates and trusts and lines of credits from which money may be borrowed to make payment. We accept payment from your credit or debit cards. Albany New York Gross annual income.

You can take out a mortgage for the share you own usually between 25 and 75 while paying rent on the rest to a housing association. It is acceptable in most countries and thus making it the most effective payment method. Second mortgage types Lump sum.

11159 Annual interest rate. If you need to chat through your mortgage options or want to find out more about shared equity mortgage lenders call our mortgage partner London Country on 0844 209 8725 for fee-free independent advice. Cashing out some home equity Julie has a home worth 500000.

Accessing Mortgage Financing Options For Buyers Of Shared Equity Homes Grounded Solutions Network

How To Get A Home Equity Loan With Bad Credit Forbes Advisor

5 Best Loans For Bad Credit Of 2022 Money

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Can I Get A Shared Ownership Mortgage With Bad Credit Haysto

How To Get A Home Equity Loan If You Have Bad Credit Nerdwallet

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Bad Credit And Large Deposits How To Lower The Risk

Best Bad Credit Loans For September 2022 Nextadvisor With Time

Unlock Review 2022 Bankrate

Second Mortgage Loans Vs Heloc Visual Ly

Can I Get A Shared Ownership Mortgage With Bad Credit Haysto

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Can I Get A Shared Ownership Mortgage With Bad Credit Haysto

5 Best Home Equity Sharing Companies August 2022 Lendedu

Can I Get A Shared Ownership Mortgage With Bad Credit Haysto

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Wha Loans For Bad Credit Bad Credit Mortgage No Credit Loans